Send your

tax return

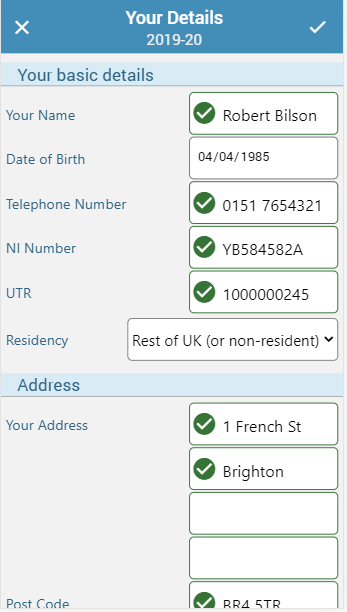

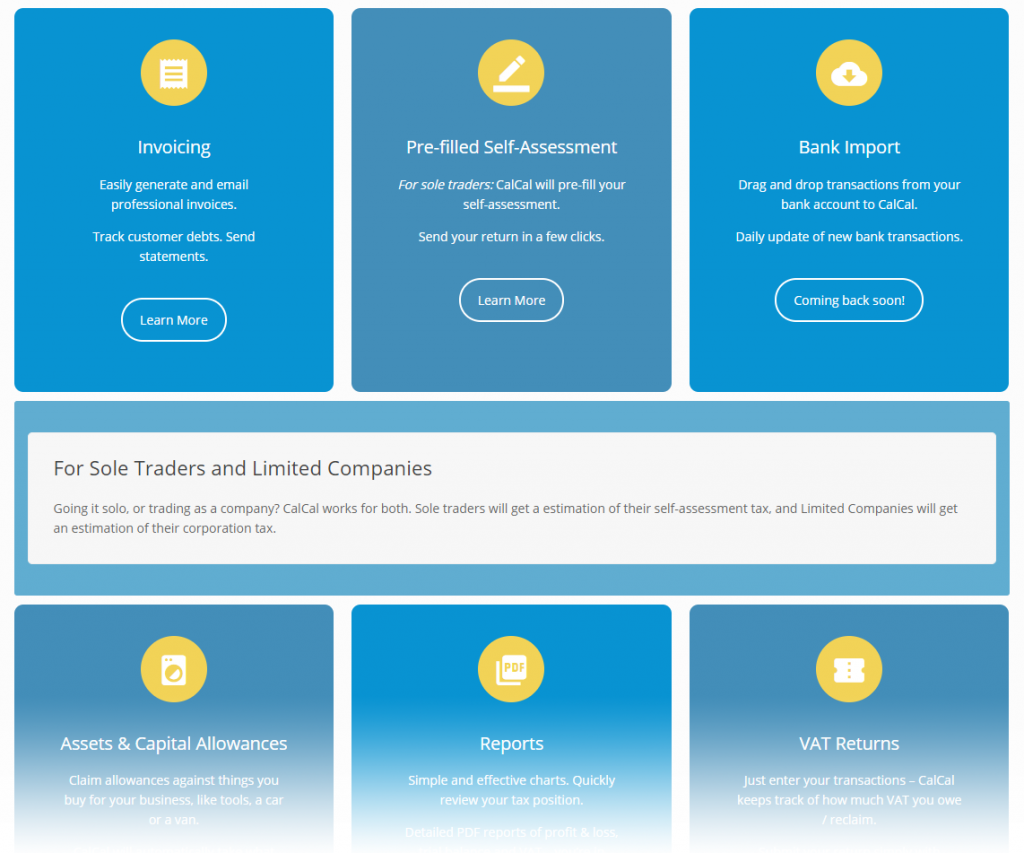

Submit your UK tax return online to HMRC via CalCal.

Be Confident in Your Submission

Your return is automatically checked for errors before you send it, with notification that it's been accepted within 10 seconds.

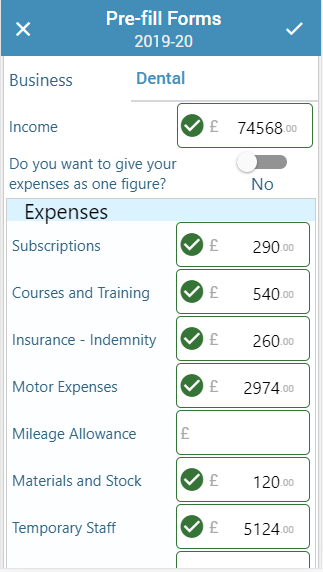

Self-employed? CalCal will automatically fill in your tax return.

Recognised by HMRC since 2015

3 Simple Steps

Making Tax Simple for Self-Employed

Enter your expenses as one figure, or as expense types adapted to your business. Then just check through your forms and submit!

- CalCal will fill in your tax return for you!

"I am quite impressed with your service. I will be recommending you to others. Good job. Cheers!"

- F.D. from Southwest France

Non-resident Tax Returns

CalCal's Self-Assessment submission includes the NRD (Residence, Remittance Basis) SA109 schedule, along with any other forms you need to add:

UK Property, Trusts, Capital Gains, etc

You usually have to pay tax on your UK income even if you're not a UK resident. Income includes things like pension, rental income, savings interest, wages.

Some people who are resident and have a domicile outside in the UK can also fill in the SA109 to use the remittance basis

See more details on HMRC's website.

Sign up and send for £35

Frequently Asked Questions

- Register

with HMRC for self-assessment tax return. Find out more - Sign Up

with CalCal. £35 per person per tax year - Fill In

Follow the three simple steps to fill in your self-assessment forms - Submit

your tax return and keep a record of submission

You'll need a government gateway ID to do this

You will likely only need to submit a couple of forms, but should you need any more, CalCal supports the forms indicated below:

- SA100 - Individual Tax Return

SA101 - Additional Information schedules

SA102 - Employment

SA103S - Self-employment (short, if below VAT threshold)

SA103F - Self-employment (longer, if above VAT threshold)

SA104 - Partnerships

SA105 - UK Property Income

SA106 - Foreign Income or Gains

SA107 - Trusts

SA108 - Capital Gains

SA110 - Your Calculation

SA109 - Non-residents / domiciles and remittance basis