The Assets Report is a combination of your Capital Allowances report and asset depreciation.

More details about assets and their taxable / non-taxable values is available on the Assets Entries screen.

Capital Allowances

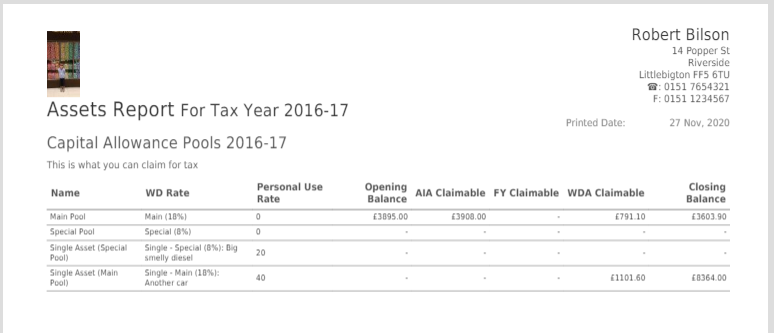

The first page of the report details your “Capital Allowance Pools”

When you purchase an asset and add it to CalCal, it will be automatically assigned to a “pool”. The details of how this works are quite complex, but don’t worry – all you have to do is tell CalCal what type of asset this is (tool, car, etc.) and whether you’re using it for non-business purposes some of the time.

The Capital Allowance Pools page shows these pools, and their allowances for the chosen year. There are three types of allowances you can claim:

- AIA – Annual Investment Allowance

- Lets you claim the total expense against your taxable profit for things like tools and machinery

- FY – First Year Claimable

- Some special energy-efficient assets are elligible for this

- WDA – Writing Down Allowances

- Some things like cars can be claimed at 8% or 18% per year. CalCal will keep track of these (in pools) for you.

When you add your assets to CalCal, this will all be worked out for you and automatically entered into your tax return!

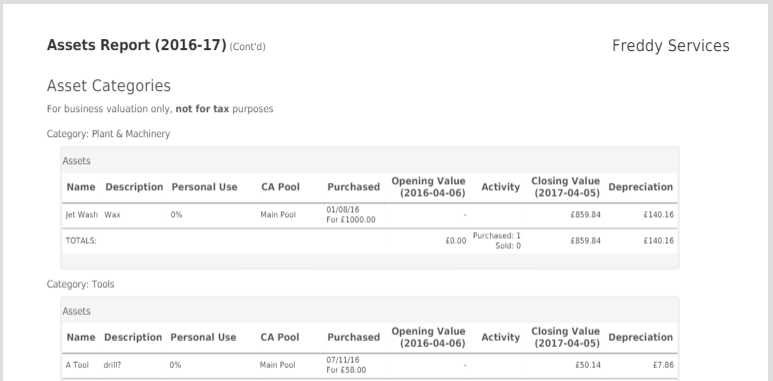

Asset Categories

The subsequent pages of this report detail the nothing-to-do-with-tax value of your assets and their depreciation

You can change the depreciation rate of assets and add valuations in Asset Entries