Have you been told by HMRC which forms you need to fill in?

Trying to figure out all those SA100 numbers? Here’s your guide

Which forms can CalCal Send?

CalCal will pre-fill the following forms with the information you give:

- SA100 – Main Self-Assessment

- SA101 – Additional Information

- SA103S or SA103F – Self-Employment: Your year’s takings and expenses by category, capital allowances, balance sheet. Depending on your turnover, the short or full schedule will automatically be added.

- SA105 – UK property income (if you sign up as a landlord)

- SA110 – Tax calculation is done for you before you submit

In addition, you can optionally add any of the following forms for submission through CalCal:

- employees or company directors – SA102

- self-employment – SA103S or SA103F

- foreign income or gains – SA106

- trusts – SA107

- non-UK residents or dual residents – SA109 (See our Non-Resident subscription if you require this)

Which form is which?

HMRC has a list of SA100 forms here and we’ve made a table to help you…

| SA100 | The whole form (steps 1-5) | |

| SA101 | ASE, AOR, MCA, AIL, AOI | Additional Information schedules |

| SA102 | EMP | Employment |

| SA103S | SSE | Self-employment (short, if below VAT threshold) |

| SA103F | FSE | Self-employment (longer, if above VAT threshold) |

| SA104 | Not supported | Partnerships |

| SA105 | PRO | UK Property Income |

| SA106 | FOR | Foreign Income or Gains |

| SA107 | TRU | Trusts |

| SA108 | Not supported | Capital Gains |

| SA109 | NRD | Non-residents / domiciles |

| SA110 | CAL | Your calculation (step 4) |

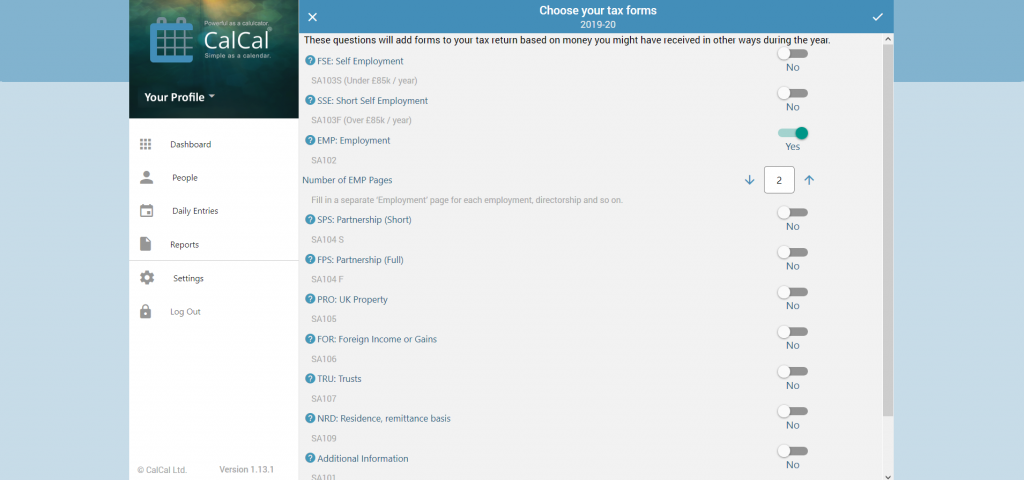

How to select your forms

Step 2 on the self-assessment entry lets you switch these forms on and off…

For some of these forms, like employment shown here, you can add up to 6 of the same form. You may have a couple of employers, or be a director or more than one company, for example.