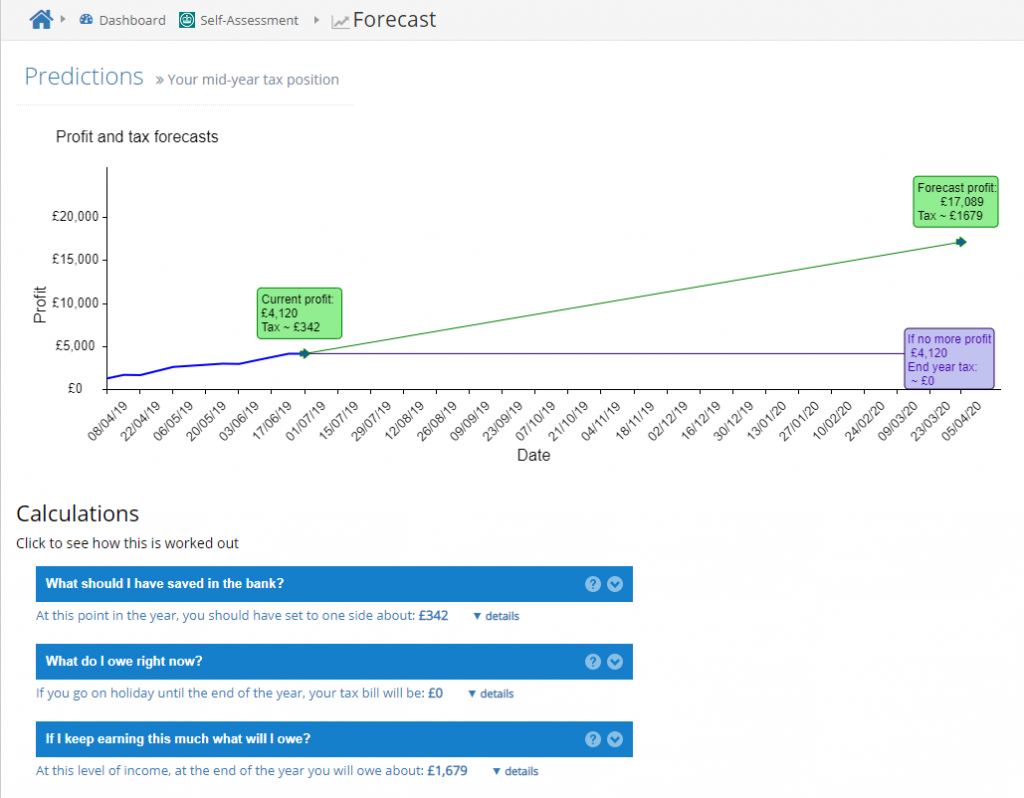

CalCal gives you a few estimates of your tax position

What Should I have Saved In The Bank?

This calculation shows approximately how much you should have set to one side for your tax bill later in the year.

This figure takes into account all of your allowances and limits proportionally through the year. This means it will increase slowly and steadily as you earn more.

If you keep an eye on this figure, and ensure you have this amount saved in the bank (or mattress), you can avoid a nasty shock when it comes to Self-Assessment time!

Note, there are some things that can’t be taken into account with this calculation at the moment. I.e. If you sell an asset, or if your stock levels change considerably by the end of the year, you will see some difference between this figure and the final tax bill. It’s designed as a helpful guide really.

What Do I Owe Right Now?

This calculation shows what you would owe if the tax year ended today.

It doesn’t split your allowances and tax-free limits proportionally, so for example until you earn over £12,500 this figure will be zero.

Once you cross each threshold, the tax in this calculation will suddenly start to increase faster. Don’t worry though, this just lets you see a running figure.

(And if you’re fortunate enough to be going on holiday until 5th April, well it’s a good figure to know!)

Note, there are some things that can’t be taken into account with this calculation at the moment. I.e. If you sell an asset, or if your stock levels change considerably by the end of the year, you will see some difference between this figure and the final tax bill. It’s designed as a helpful guide really.

If I Keep Earning This Much What Will I Owe?

This forecast estimates how much profit your business will make this entire tax year.

If you do keep earning at this rate, this calculation shows approximately how much your tax bill will be.

Note, there are some things that can’t be taken into account with this calculation at the moment. I.e. If you sell an asset, or if your stock levels change considerably by the end of the year, you will see some difference between this figure and the final tax bill. It’s designed as a helpful guide really.