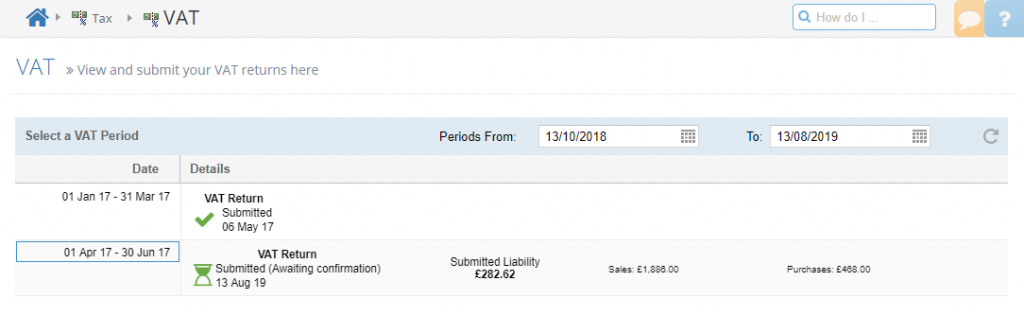

Once you’re connected to HMRC’s MTD service, the VAT screen consists of two sections:

List of VAT Periods

The first thing you’ll see is a list of VAT periods.

If you’re new to MTD VAT, you’ll only see one or two periods, and you’ll probably need to submit one.

Click on a period to show more details.

These VAT periods are called ‘obligations’ by HMRC, and they’re either submitted or not. Once submitted, CalCal will limit which transactions you can change between those dates.

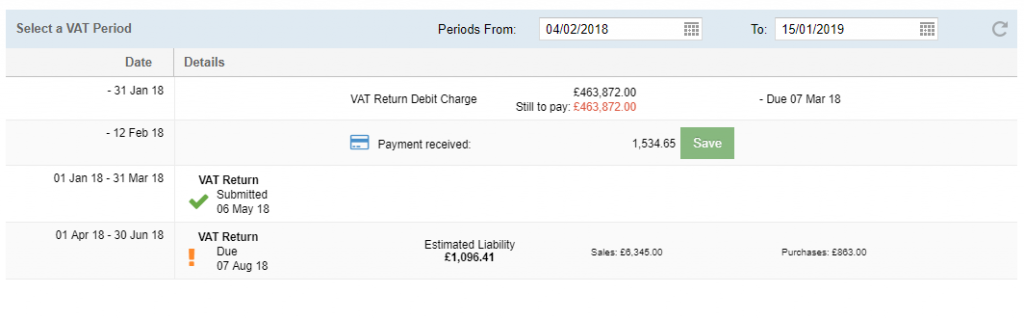

Your Liabilities and Charges

Your VAT bills will show here in the same list. If you click on one, CalCal will give you a link to find out more in your Business Tax Account.

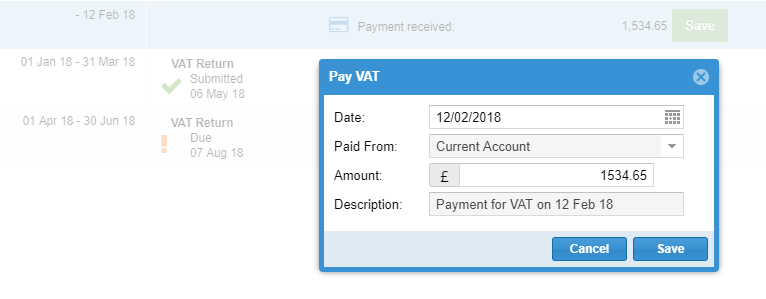

See Payments Received by HMRC

Payments that appear in your list can be added into CalCal. Just press the green ‘save’ button.

If you use our Bank Import feature, this will help you marry up the bank transaction with the VAT payment.

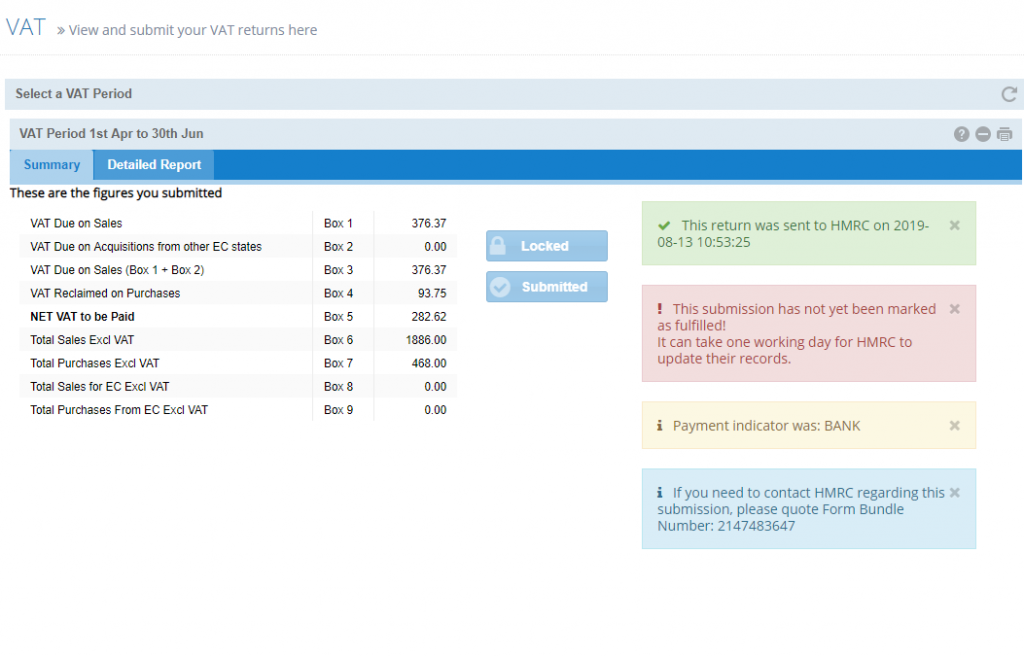

Details for a Period

When you select a VAT period from the list, the details tab will expand.

For submitted periods, details will be pulled in from HMRC. For the current period, CalCal will show you the totals to date.

Select the Detailed Report tab to show your VAT report for the selected period. Press the print button to download the PDF report for the period.

This post is also available in: فارسی