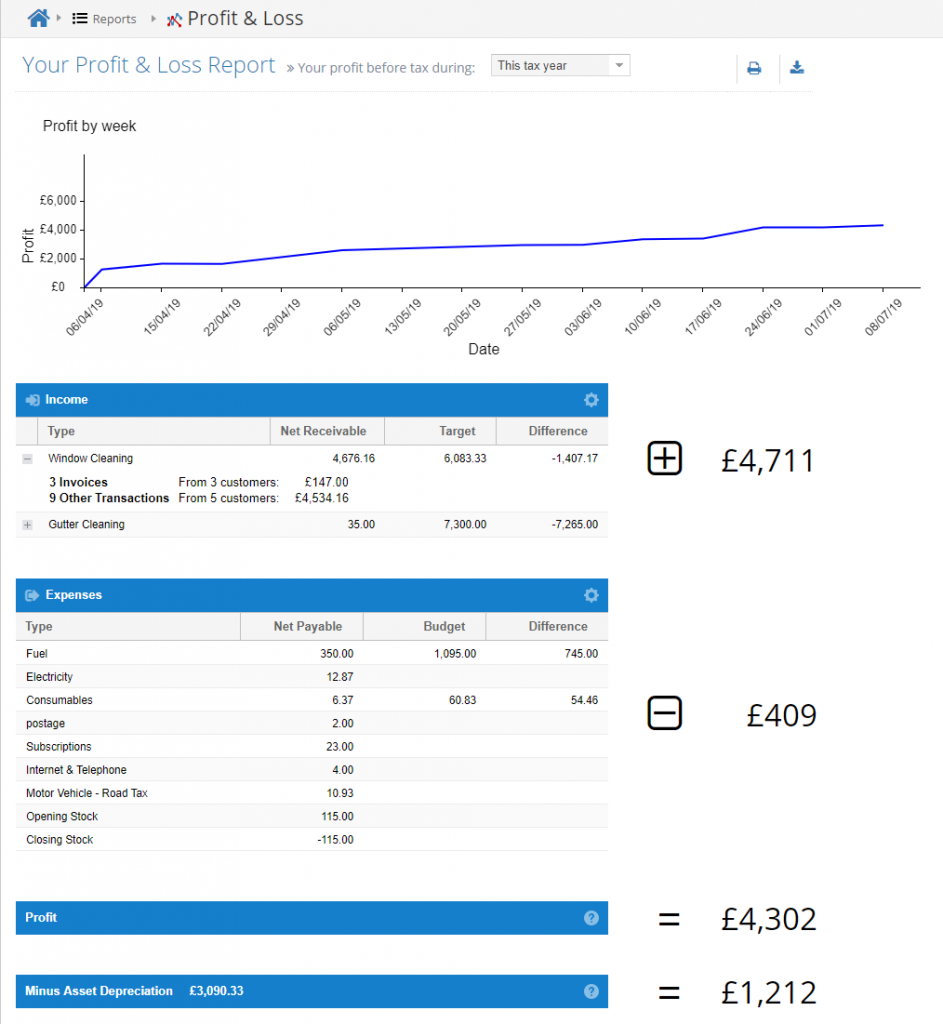

The Profit & Loss report shows your income and expenses for the period you select. By default this will be your current tax year, but you can also select any tax period or use the “Specify” selection to choose exact dates.

You can also manage your budgets and tagets here – see the Budgets and Targets help page for more information.

Income

Your total net income from different sources

If you have set up more than one income type, you’ll see them listed separately here. You might like to keep track of takings from one source separately from another, to see which is more lucrative or to set targets. You can do this by clicking the cog button on the Income header.

If you expand an income type (or just ‘sales’ if you didn’t create any others), you’ll see a breakdown of your income. Keep in mind that not all income has to be assigned to a customer, though.

Expenses

Your net expenditure for the period by expense type

If you have set up budgets, each category’s expenditure will be compared to the budget for the selected period. So if, for example, you want to compare the last 3 months’ expenses to your budgets, change the dropdown at the top to “Past 3 months”. Budgets are “per month” and calculated daily.

Profit

Simply income minus expenses.

If you’re VAT-registered, this will all be Net.

Minus Asset Depreciation

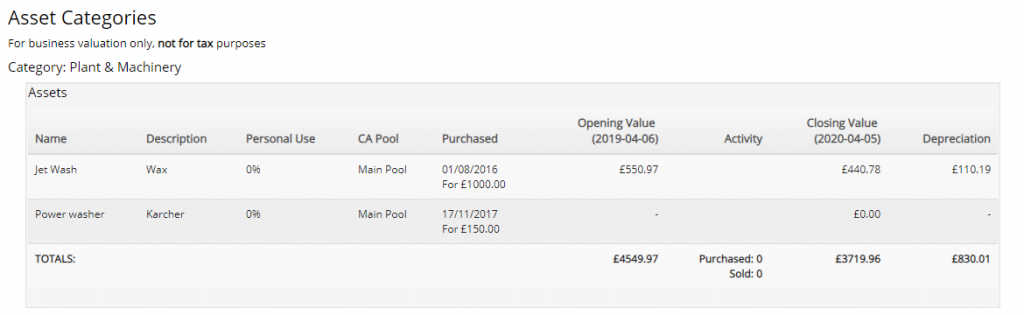

This shows an estimate of your profit, after taking into account depreciation in the value of your assets each year.

When you add assets in the Entries->Assets screen, CalCal works out your capital allowances (tax allowances that let you take some of the asset’s value off your taxable profit) separately from the asset’s depreciation.

CalCal will give you an estimate of the current value of an asset based on either/or:

- A default depreciation rate for the asset’s category (eg. 20%)

- The depreciation rate you set under Advanced section when adding the asset

- A more recent valuation you add for the asset

At the end of the tax year, the difference between the value of your fixed assets at the start vs. the end of the year helps you see how much profit your business has actually made.

To see more about assets, visit our Assets help page