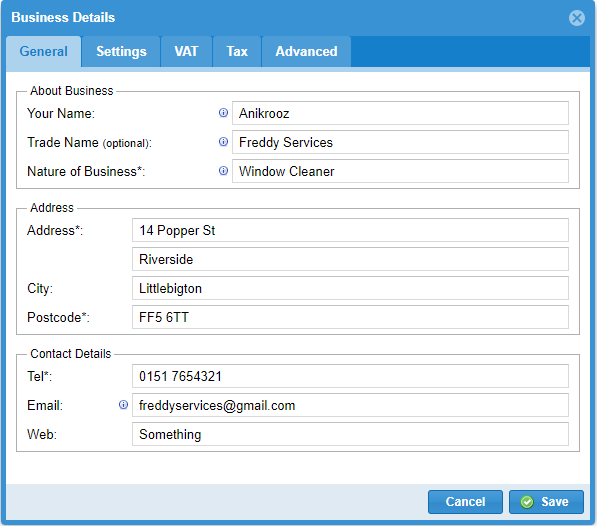

The Business Details settings box contains most of the important information CalCal needs to know about your business.

For example, when you make an invoice, you may want it to show your contact details. If you’re using CalCal’s VAT and self-assessment features, you’ll need to enter your business and personal tax numbers here.

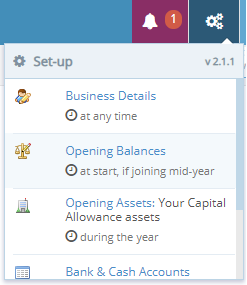

There are two ways to open the Business Details settings box:

General Tab

Many of these boxes are used when CalCal pre-fills your tax return for you. You will need to fill in the boxes marked with a * star before you can send your tax return.

Business Name

Your business name is what you set when you signed up to CalCal. It’s used on your self-assessment if you send it through CalCal, so if you’re self-employed this will be your personal name. If a limited company, this will be your registered company name.

Trade Name

On invoices, statements and reports, CalCal will use your business name unless you enter a trade name here. You can out something like “Ant’s Gardening Services” here even if you’re self-employed.

Nature of Business

Eg. “Gardening services,” “Window cleaner,” “Taxi Driver”.

This will be used by CalCal when filling in your tax return (if self-employed). It will be pre-filled into the “Description of business” box of the Self-Employed (SA103) section of your Self Assessment return.

Email address

Will appear on most PDFs generated by CalCal.

When CalCal sends your invoices and statements for you via email, this will be used as your reply-to address.

You can use a different email address here than the one you give to CalCal

(you can change that one by going to the Profile and Password page).

Settings Tab

Invoice Prefix

Default is “IN” which will generate invoice numbers like “IN00062”

You can change this to match your current invoice numbering style if you like. It will always be followed by 5 numbers (until you’ve used CalCal for a million invoices!)

Try to keep this short, 2-5 characters works best.

Default Invoice Term

The number of days new invoices should allow until their due date. You can change for each invoice this when making the invoice.

VAT Registered

You can’t change this here, but if you do need to become VAT registered while you’re already using CalCal, please contact us.

Expense and Income Types

You can view your expense types and income types here, add new ones and set budgets or targets.

You don’t have to set up all your expense types here before you start entering expenses, though. You can search for and add expense types on the fly as you add expenses.

Opening Balances Date

Usually the start of the tax year in which you joined CalCal (eg. 06/04/2019)

If you have decided to ‘lump up’ your transactions between the start of the year and when you joined CalCal, this date tells calcal when your accounts were made up to.

For example: If you joined CalCal on 20th May, you can either:

- Enter each and every transaction between 6th April and 20th May,

- OR: Separately add up your expenses and takings between 6th April and, say, 20th May. Then you would set this date to 20th May and ‘Opening Balances’ will ask you for your mid-year balances. Anything after 20th May would then need to be entered individually on the CalCal calendar.

You can only change this date if you have not yet entered any transactions into CalCal

The VAT Tab

If you’re VAT registered, you’ll need to enter your VAT details here.

VAT Number

Your VAT number will be used when you connect to MTD VAT and will also be shown on invoices.

VAT Direct-Debit account

When HMRC tells you through CalCal that they will be collecting your VAT payment via Direct Debit, CalCal will automatically enter the transaction against this account. You just need to tell us which of the accounts you’ve put in CalCal this will be.

The Tax Tab

For the self-employed

To fill out your tax return correctly, CalCal needs your UTR, NI Number and date of birth.

National Insurance Number

Your NI number can be found on letters from HMRC and also when you log in to your personal tax account.

Unique Taxpayer Reference (UTR)

Your UTR is given to you when you sign up as self-employed. If you don’t know it or can’t find it, HMRC can help you.

This post is also available in: فارسی