Your Self-Assessment - Filled Out Automatically

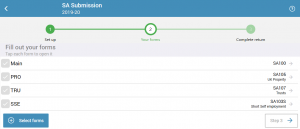

At the end of the year, CalCal will fill in your tax return with the facts and figures from your business. Including capital allowances and expense categories. Just look through our online forms and see if you need to add any other details. If you do, no worries – CalCal will include it on your tax return.

Interactive Features Save You Time

We’re working with HMRC to add interactive features – log in to your HMRC portal and CalCal will sync up your marriage allowance and national insurance without you having to look it all up.

CalCal will pre-fill the following forms with the information you give:

- SA100 – Main Self-Assessment

- SA101 – Additional Information

- SA103S / SA103F – Self-Employment: Your year’s takings and expenses by category, capital allowances, balance sheet. Depending on your turnover, the short or full schedule will automatically be added.

- SA105 – UK property income

- SA110 – Tax calculation is done for you before you submit

In addition, you can optionally add any of the following forms for submission through CalCal:

- SA102 – Employees or company directors

- SA106 – Foreign income or gains

- SA107 – Trusts

- SA109 – Non-resident (See our Just Tax Return subscription if you require this)

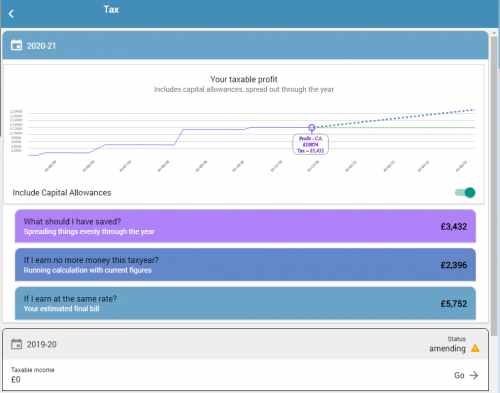

Estimate your tax position through the year

See your forecast profit and tax, what you would owe right now and how much you should have saved up for your tax bill.

See our help pages for more information on the Tax Forecast feature.